Cap On Mortgage Interest Deduction 2025. See the crs report for mortgage interest deductions. We’re talking about the interest portion of your mortgage payment that you make each.

Starting in 2026, the $10,000 cap will not apply, and taxpayers can deduct all eligible state and local income, sales (instead. Tax benefits under section 24 (b) allow for an interest tax deduction on home loan up to ₹2 lakhs.

If you claim the standard deduction of $14,600 for your 2025 tax return, your taxable income for the year would be $115,400.

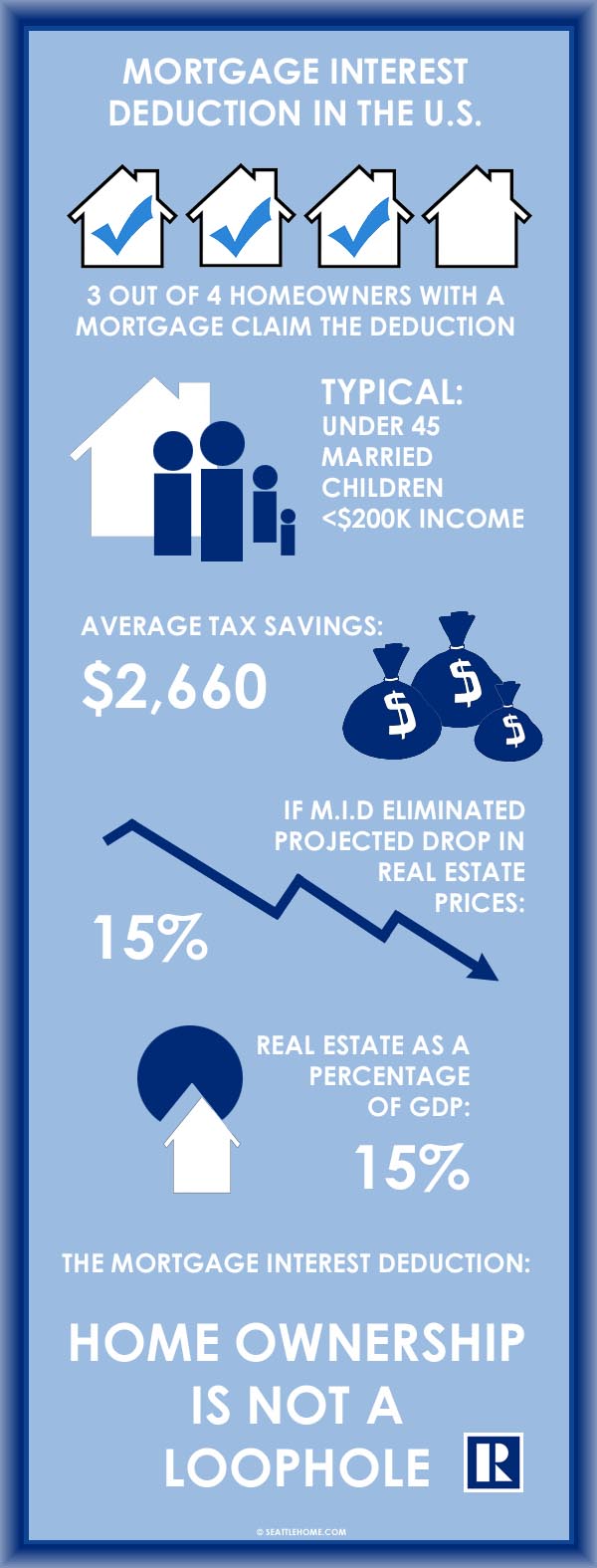

Mortgage Interest Deduction Guide 2025 US Expat Tax Service, In a nutshell — yes. Current loans of up to $1 million are grandfathered.

Understanding the Mortgage Interest Deduction The Official Blog of, The salt cap was not indexed for inflation. There's no cap on how much interest you can deduct on your taxes when utilizing this deduction, but there are limits to how much of the loan amount can be used.

Mortgage Interest Tax Deductions 101 (Updated for 2025), Also, the tcja lowered the cap on mortgage interest deductions from $1 million to $750,000 for married couples filing jointly, and from $500,000 to $375,000 for. If you paid more than $600 in mortgage interest last year, keep an eye out for a form 1098 from your mortgage lender in the coming weeks, (early 2025).

Understanding the Mortgage Interest Deduction With TaxSlayer, Before the tcja, the mortgage interest deduction limit was on loans up to $1 million. If you claim the standard deduction of $14,600 for your 2025 tax return, your taxable income for the year would be $115,400.

Which States Benefit Most from the Home Mortgage Interest Deduction?, You can claim the interest on your home loan. In 2017, the tax cuts and jobs act (tcja) actively modified personal income taxes.

Quick Facts You Need To Know About The Mortgage Interest Deduction, See the crs report for mortgage interest deductions. Mortgage interest is generally tax.

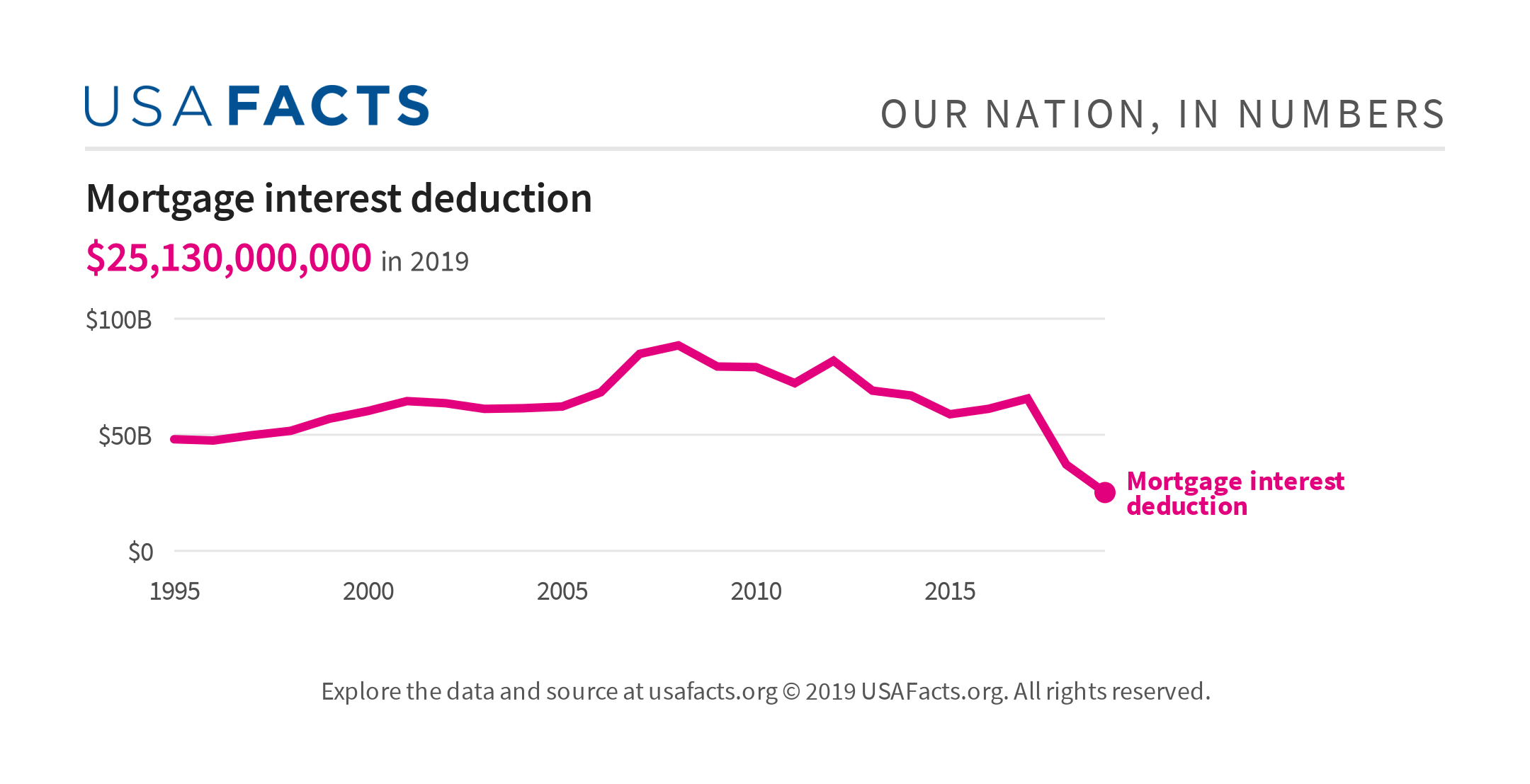

Mortgage interest deduction USAFacts, How does the tax cuts and jobs act’s temporarily. This assumes the deduction of the first quarter 2025 dividend accrual.

What Is The Prime Mortgage Rate Today Your Guide To Current Rates, Publication 936 (2025), home mortgage interest deduction. In a nutshell — yes.

What you need to know about the mortgage interest deduction, We estimate that capping the home mortgage interest deduction to mortgage debt of $500,000 would raise $319 billion over the next decade. Tax benefits under section 24 (b) allow for an interest tax deduction on home loan up to ₹2 lakhs.

MortgageInterestDeduction1 The Official Blog of TaxSlayer, Introducing changes to the mortgage interest deduction. For use in preparing 2025 returns.

This itemized deduction allows homeowners to subtract mortgage interest from their taxable income, thereby lowering the amount of taxes they owe.